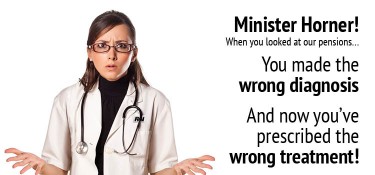

Government prescribes the wrong treatment for Alberta pensions

United Nurses of Alberta President Heather Smith and the presidents of Alberta’s other large public sector unions have written an open letter to Alberta MLAs, urging them to understand the consequences of the PC Government’s proposed changes to public sector pension plans.

On April 16, 2014, the PC Government introduced Bill 9: The Public Sector Pension Plans Amendment Act, 2014, which would give Finance Minister Doug Horner the power to impose changes that could undermine the stability of the Local Authorities Pension Plan (LAPP), which is the main retirement savings plan for the 30,000 Registered Nurses, Registered Psychiatric Nurses and allied health workers represented by United Nurses of Alberta.

UNA members are urged to contact their MLA directly by phone and email to urge them not to support Bill 9 and the government’s proposed changes to the LAPP.

UNA members continue to have five main concerns about the government’s proposed changes, some of which are so serious they threaten the long-term viability of the plans:

1. Cap on contributions: The government is pushing for a cap on pension contributions. This could be very harmful to the health of our pension plan. The danger is particularly acute if there is another market crash, as there is bound to be. As long as this is on the table, no one’s pension is safe from future cuts.

In his report, the Auditor General of Alberta agreed this was a problem:

“When a plan deficit occurs,” the Auditor General's report said, “only current and future employees can fund the employee share over an extended period of time (e.g., 15 years). This can create inequities between past, current and future employees. Practically speaking, current and future employees will not likely pay for benefits accruing to past employees if current employees’ contribution rates are significantly more than the value of their own expected pension benefits. If current and future employees will not support the plan, then the options are limited to: the employer is left to assume more of the past liability; retired employees will receive benefits that are less than promised; or the plan risks insolvency. This means changing the pension promise for current or future employees is difficult while they bear the cost and risks of benefits given to past employees.”

2. Three tiers of pensions: The government is proposing three different tiers of pension plans. One for pre-2016 benefits, one for post-2016 benefits, and one for predominantly male occupational groups including firefighters, paramedics, and corrections officers, which the government now defines as “public safety occupations.”

It is not fair that one group of workers gets to keep the “85 Factor” and a better pension plan than another for the same kind of public service. We all serve our communities, we all pay into our pensions, and we should all have pensions that operate under the same rules. This is an attempt by the PC Government to “divide and conquer” public sector workers.

Does the government really believe front-line health care workers like nurses are not “public safety workers?”

As members of a profession dominated by women, UNA members are particularly concerned that their vital front-line health care profession has been relegated to second-class status.

3. Early retirement: The government is now proposing to change pension benefits so that early retirement without penalty is available to workers who are at least 60 years old and have a combination of age and years of service that totals 90.

This is a slight improvement over the government’s last proposal, as a few people may be able to retire early, but it still means UNA members will have to work longer to receive an unreduced pension.

The revised government plan will also make it harder to retire early if a member chooses, by increasing the penalty to do so.

Currently, if a member retires before reaching the “85 Factor” (age plus years of service equal 85), there is a penalty of 3 per cent for every year they retire early. Under the latest changes, that penalty is increased to 5 per cent for every year of early retirement without the “90 Factor.”

4. Indexing: Under current pension rules, retirees are guaranteed to have their pensions indexed to 60 per cent of inflation. The government refuses to continue that guarantee and now characterizes cost of living increases as a “target” that will not always be met. This means pensioners can expect the value of their pension rapidly decrease as they get older.

5. Joint trusteeship: All unions in the Labour Coalition on Pensions, including UNA, have long supported a pension plan where workers have an equal say with employers over the management of the fund. Alberta is far behind other jurisdictions in not managing public sector pensions this way. This is not the first time the government has promised joint trusteeship. In 1992, the government made similar assurances to public sector workers.

The government is now offering joint trusteeship, which is a good thing. But it insists the changes mentioned above be implemented first, and that afterward the trustees cannot make changes to them. This gives employees a say over the management of their pensions after the government has taken steps to starve the plan of funds, and after it has reduced pensioners’ retirement security.

If the government is serious about joint trusteeship, it should implement it now. Employees and their employers can then negotiate changes to the plan as true equal partners.